philadelphia transfer tax form

INSTRUCTIONS FOR COMPLETING PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Section A Correspondent. Who pays real estate transfer tax in Philadelphia.

Cash American Cheque Possibilities Americans Overseas

Stay away from spending unneeded time use only up-to-date and accurate form templates by US Legal Forms experts.

. Think of the transfer tax or tax stamp as a sales tax on real estate. Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly. If you take an interest in Fill and create a Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia heare are the steps you need to follow.

This transfer tax is traditionally split between the buyer and the seller with each. Transfer to a Trust A transfer for no or nominal consid-. REV-183 -- Realty Transfer Tax Statement of Value.

The state of Pennsylvania charges one percent of the sales price while the municipality and school district each charge one percent of the sales price for a total of two percent ie. 2 percent X 100000 2000 in Pennsylvania. Will or Intestate Succession A transfer by will for no or nominal consideration or under the intestate succession laws is exempt from tax.

Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. The new law lowers the trigger to 75 effective July 1. Philadelphia PA 19102 215 686-6442 Real Estate revenuephilagov 215 686-6600 Taxes.

In addition the realty transfer tax on changes in entity ownership previously had been triggered upon a 90 or greater change in ownership. Fill Sign Philadelphia Form Transfer Tax 1993. Ance on the Realty Transfer Statement of Value form.

If you are selling or transferring your business you must file a Change Form in order to cancel your tax liability with the City. The advanced tools of the editor will direct you through the editable PDF template. The state of Pennsylvania charges one percent of the sales price while the municipality and school district each charge one percent of the sales price for a total of two percent ie.

Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. Provide the name of the decedent and estate file number in the space provided. The way to complete the Philadelphia form transfer taxsignNowcom 2011-2019 online.

Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being transferred. You should be aware that typically there are both state and local transfer taxes associated with this type of transaction in addition to recording fees. REV-715 -- Realty Transfer Tax Monthly Report.

Complete Edit or Print Tax Forms Instantly. Get Access to the Largest Online Library of Legal Forms for Any State. Fill Sign Philadelphia Form Transfer Tax 1993.

Enter the name address and telephone number of party completing this form. Enter your official identification and contact details. We use cookies to improve security personalize the user experience enhance our marketing.

Consider the transfer tax sometimes known as a tax stamp to be a type of sales tax on real estate. The State rate remains at 1 and the state has not enacted. Philadelphia Pennsylvania Realty Transfer Tax Statement of Consideration Download the form youre searching for from your website library.

Philadelphias transfer tax is one of the highest rates within Pennsylvania. PA Realty Transfer Tax and New Home Construction. The Sheriffs Office will also continue to host food giveaways and virtual town halls to answer any questions that residents may have.

The Guide of finalizing Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia Online. The Guide of finalizing Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia Online. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

2 percent X 100000 2000 in Pennsylvania. 8102-C5 in every county in which the corporation or association owns real estate. A Corporation or Association that qualifies as a Real Estate Company must file a Declaration of Acquisition form within thirty 30 days after becoming an Acquired Company as defined in 72 PS.

Section B Transfer Data. REV-183 -- Realty Transfer Tax Statement of Value. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a.

2 X 100000 2000. Enter the date on which the deed or other document was accepted by the Partyies. To begin the form utilize the Fill camp.

When you submit the sale document for recording you will be required to pay the Real Estate Transfer Tax. REV-1651 -- Application for Refund PA Realty Transfer Tax. Enter the date on which the deed or other document was accepted by the Partyies.

Sign Online button or tick the preview image of the blank. INSTRUCTIONS FOR COMPLETING PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Section A Correspondent. The new owner must apply for a new Tax Account Number and a new Business privilege License.

The State of Pennsylvania charges 1 of the sales price and the municipality and school district USUALLY charge 1 between them for a total of 2 ie. Revenue Code Chapter 91 -- Revenue Code - Chp 91. If there are any questions that a resident may have they can reach out to the Philadelphia Sheriffs.

Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. Get the free philadelphia realty transfer tax form 2011-2022. Sell or transfer a business.

Consider the transfer tax sometimes known as a tax stamp to be a type of sales tax on real estate. Both these changes are in addition to the increase in the Citys tax rate to 31. Section B Transfer Data.

Enter the name address and telephone number of party completing this form. The Philadelphia Real Estate Transfer Tax Certification form is required in duplicate. REV-1728 -- Realty Transfer Tax Declaration of Acquisition.

2 rows When you complete a sale or transfer of real estate that is located in Philadelphia you must. Ad Access Tax Forms. Hit the Get Form Button on this page.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is.

Nominal consideration or under the intestate succession. For comparison Montgomery County Pennsylvanias transfer tax is only 1.

Tax Refunds Delayed 2022 How To Get Your Refund Faster Marca

Tax Filing Season 2022 What To Do Before January 24 Marca

Child Tax Credit January 2022 When Could Ctc Payments Start In 2022 Marca

Operations Transformation Fund Fall 2021 Grantees Office Of The Chief Administrative Officer City Of Philadelphia

Stimulus Tax Rebates Amount Eligibility And Deadline Marca

Office Of Community Empowerment And Opportunity Homepage City Of Philadelphia

Irs Refunds Why Does It Mark A Math Error And What Can I Do Marca

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Office Of Community Empowerment And Opportunity Homepage City Of Philadelphia

Pennsylvania Quit Claim Deed Form Quites The Deed Nevada

3438 Decatur St Philadelphia Pa 19136 Trulia

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

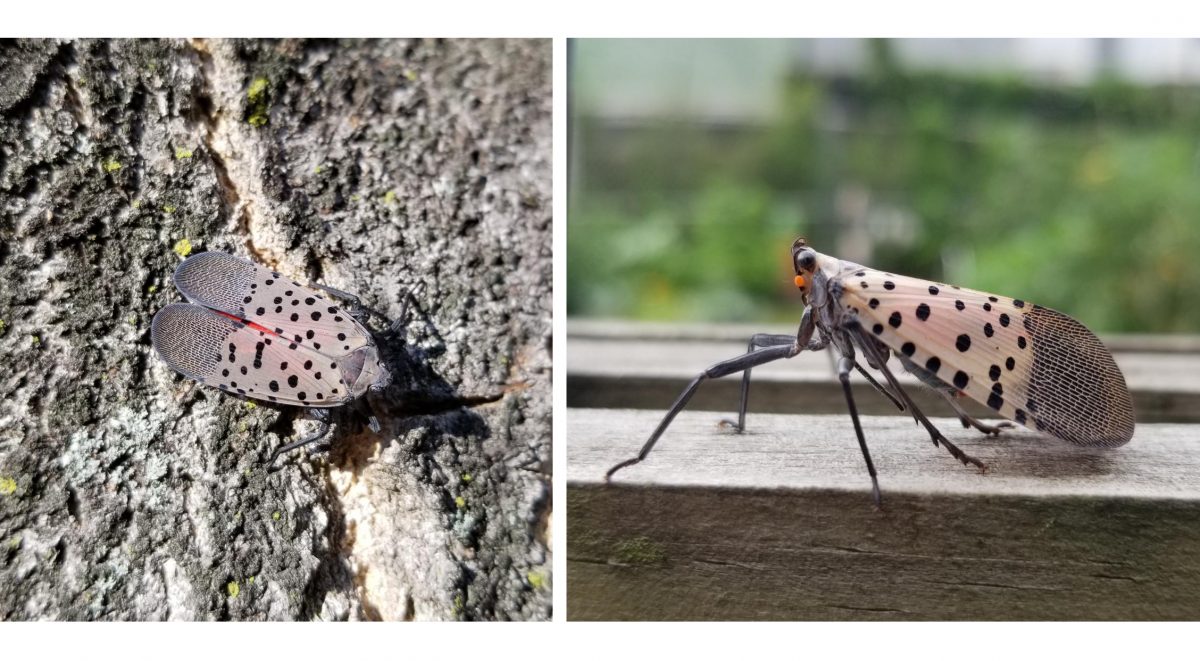

How You Can Help Stop The Spotted Lanternfly In Philadelphia Philadelphia Parks Recreation City Of Philadelphia

Office Of Community Empowerment And Opportunity Homepage City Of Philadelphia

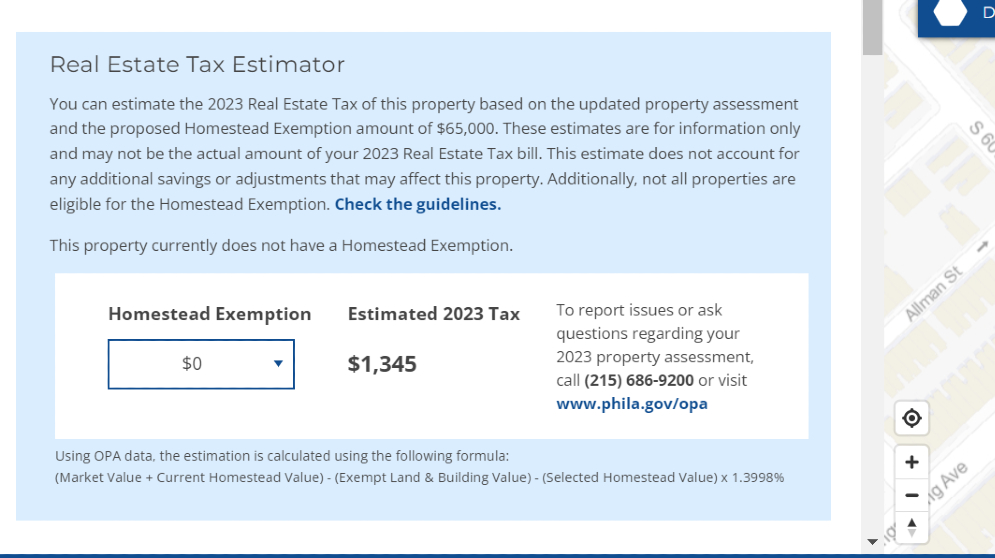

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Make An Appointment For An In Person Payment Department Of Revenue City Of Philadelphia

Operations Transformation Fund Fall 2021 Grantees Office Of The Chief Administrative Officer City Of Philadelphia

6 Things To Know The Ending The Hiv Epidemic In Philadelphia Plan Department Of Public Health City Of Philadelphia